Wireless Insiders Now On Your Side

Cell Tower Lease Rates

Tower Lease 101 > Cell Tower Lease Rates

Cell Tower Lease Rates in 2022

At Terabonne, we pursue the highest cell tower lease rates that are warranted on a client’s unique property based on future cellular traffic volume. A “fair market rent” should never depend on the cell tower lease rates of neighboring properties since they may not be receiving appropriate and fair lease rates themselves. Instead, rent should be based on the site’s value to the AT&T, Verizon, T-Mobile, and Dish WirelessDish Wireless entered the cellular business in 2020. Dish is poised to become the country’s 4th largest wireless carrier by building its own wireless infrastructure to mimic Verizon, AT&T, and T-Mobile networks.. A site’s value is determined by factors such as its cellular traffic, data throughputs, zoning restrictions, and competing properties. We negotiate cell tower and rooftop leases responsibly by only taking on an amount of risk that is absolutely necessary to advance our clients’ goals and by shifting the excess risks to the wireless carriers. The reason we shift the excess risk to the carriers (such as Verizon or Dish Wireless) is because property owners’ risks are driven by the carriers who brought on an inherently dangerous operation to the property owners’ land. Risks such as tower climbing, high voltage power, and environmentally hazardous substances are introduced to the property because of cell tower operations. This is why the carriers should be the ones to assume these contractual and legal risks. Unsurprisingly, wireless carriers offer leases that are very one-sided in their favor. These poorly presented cell tower lease terms give the carriers the upper hand while landlords are stuck with unnecessary assumptions of legal liabilities and risks. Terabonne balances the equation and creates a level playing field because we understand the wireless carriers’ underlying motivations and know how to negotiate every sentence of the lease to our clients’ favor.

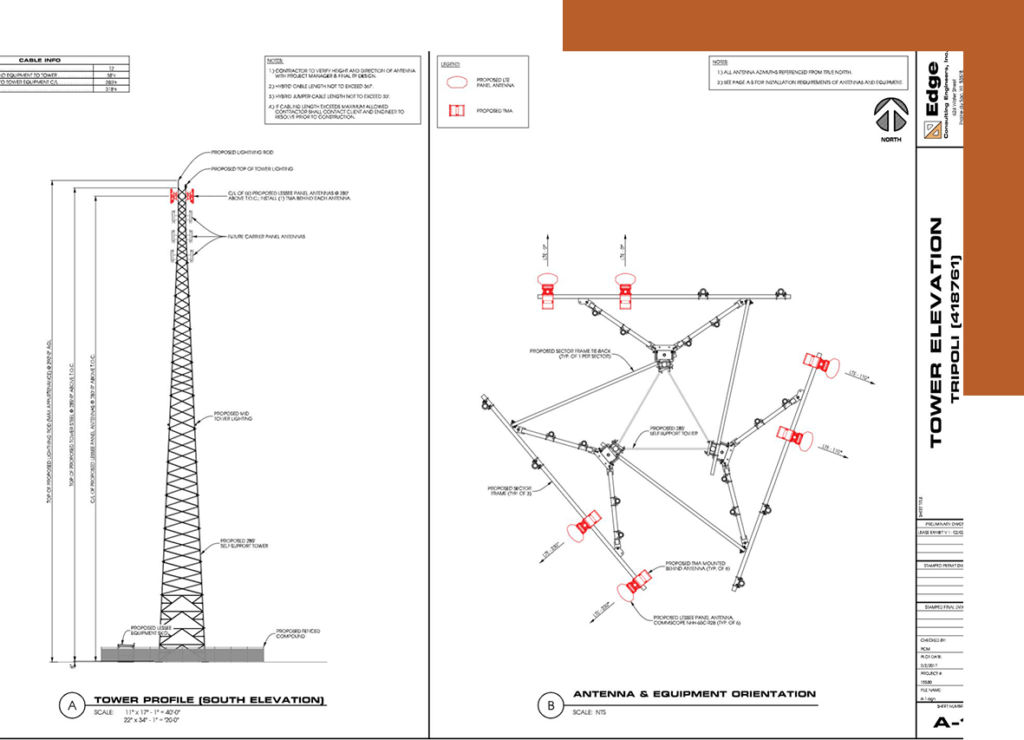

Most importantly, we understand what drives the engineering, designs, and risks that are spelled out in the lease terms. Over the past 25 years, cell tower and rooftop leases have advanced through trial and error. As a result of our experience working for wireless carriers, Terabonne is entrenched in the progression of wireless leases and the history and logic behind individual clauses. This is the engineering, industry, and leasing know-how that you, the property owner, have on your side to help you take advantage of your cell tower leasing opportunity. At Terabonne, a tower build opportunity is not limited to just negotiating the lease. It is only a portion of what we deliver to our clients when managing the entire build project.

Average Cell Tower Lease Rates

The phrase “average cell tower lease rates” is a misnomer. Cell tower lease rates for commercial properties are vastly different for rural farm use vs. metropolitan industrial properties. They vary if the tower is near an international airport or a freeway intersection. Statements by those claiming to have the “largest database of lease rates” or “average 300% rent increase” should be met with high suspicion. This is called Click Bait and property owners should be cautious with those who make these outlandish claims.

For example, we don’t use the “average home price” in the country to determine your home price. The same is true with cell tower rent rates. Factors that determine lease rates for any cell tower are determined by how the wireless carriers intend to use it to improve their system’s cellular traffic needs. A site in New York can get substantially less rent than a site in Montana under the right conditions. We do not discount a cell site’s rent because of its location alone. An understanding of the engineering, concentration of population, venue, commerce activities, zoning restrictions, competition and cellular designs all contribute to determining how the wireless carriers intend on loading up the tower’s traffic volume. This provides the guidance on your cell tower lease rates.

At Terabonne, while we have information on a tremendous amount of lease rates due to the volume of our leasing activities, the information is never used to “average” out our clients’ rent. We do our own independent research on every site and determine what the overall cell tower lease rate should be for our clients.

Commercial Cell Tower Lease Rates

The location of a cell site (tower or rooftop) influences cell tower lease rates. Commercial properties tend to be the preferred zoning classifications for cell towers. It is easier to zone. But available space for cell tower operations tend to be limited in these situations. In commercial leases, we generally limit the leased space within the 250 to 500 square feet range, depending on space availability and tower design requirements. If the wireless carriers want more space, it can be made available to accommodate an expansion, but of course, we would require additional rent for our clients. Managing leasable space is key to maximizing our clients’ income potential on their properties. Access and easements are also very important as we want to control how power, telco and fiber optic are brought to the site and manage the trenching for conduit runs in the most expedient ways for our clients. Parking and generator locations for both temporary and permanent fixtures are important to design and negotiate early to avoid interfering with our clients’ use of their commercial operations.

When designed and negotiated correctly, having a wireless lease on your property is like winning the lottery. If you’ve been approached by a wireless carrier representative about the possibility of having a cell tower built on your property, this is a valuable opportunity to gain a consistent long-term stream of revenue. Therefore, it is important to move quickly and strategically. Wireless carriers will identify at least three site candidates within their Search Rings Geographical areas depicted in a circle (ring) drawn by radio frequency (RF) engineers defining the areas requiring new cell towers and technical parameters surrounding such designs., meaning you and your neighbors will be approached with the same competing opportunity. The wireless carriers will play one neighbor’s cell tower lease rate against the others. When a carrier representative contacts you about a lease on your property for a wireless operation, engaging Terabonne to represent you right away is the smart initial step. We are ready to help you understand the opportunity and risks that are specific to your land. Whether or not you retain Terabonne to represent your interests, at a minimum, you will have a better understanding and guidance on the next steps you can take.

Rural Cell Tower Lease Rates

Wireless carriers and tower developers are more “relaxed” in their cell tower designs and equipment engineering on rural properties, creating a much larger space footprint than on other property types. It is common for wireless tenants to negotiate a 10,000 square foot compound for their rural tower operations. In some cases this is warranted. In most operations, however, we find this amount to be excessive. We do not allow immoderate land acquisition by wireless tenants unless they can prove to us that their engineering designs do call for that much ground space. The starting offers by AT&T or Verizon (or their tower developers like Tillman, Atlas or Harmoni Towers) for rural properties tend to be around $500-$800 in monthly cell tower rent amounts. Many rural property owners trust that the wireless carrier’s personnel have offered them a fair rate and standard terms, and accept the lease as-is without much negotiation. As a business, this drives the carriers to offer lower tower rents and the most one-sided contract terms to rural property owners. We remind all property owners that leasing agents who approach you for a cell tower lease work for the wireless carriers. Their loyalty is to their employer, not to you. Placing your trust in wireless carrier representatives is like trusting the car salesman to have your interest at heart. Terabonne’s loyalty is only to our clients so we take the duty seriously when representing them in all matters of cell tower lease negotiations.

Rooftop Cell Tower Lease Rates

Rooftop leases are a very special kind of cell site lease requiring greater precision in engineering designs, including where the antennas will be installed, how they will be attached (think roof membrane protection), structural loading, coring through the floors to get cables from the equipment room to the rooftop, dog house designs, cable trays, parapet attachments, and how the roof may be maintained or re-roofed in the future with the new wireless equipment in place. The lease language must be very precise on the “Permitted Use” term to assure the carriers do not hide loopholes in the lease to expand their equipment to all of the roof without engineering and leasing reviews by the property owner. It is important to make all the terms explicit in the lease so there are no interpretations and disputes later. An innocent-looking term such as “Interference” could prevent the landlord from maximizing his income potential forevermore.

Verizon Cell Tower Lease Rates

Verizon leases are different from one part of the country to another. Verizon’s corporate office provides many different versions of the same lease terms and allows their local Verizon market managers and outside legal counsels to pick and choose among different terms depending on the situations and demands from property owners. Experience and repetition tells us how far we can push and in which direction to get the terms we need for our clients. Of all the lease terms in a standard Verizon’s lease, we most disfavor their desire to squat on property owners’ land for free forever. Terabonne’s history negotiating with Verizon tells us, however, that they will remove this term when pressed. In different parts of the country, Verizon also has burdensome insurance terms that put excessive responsibility on property owners. These, and many other improper terms, are what we look out for and negotiate fairly for our clients.

AT&T Cell Tower Lease Rates

AT&T places great emphasis on their “Permitted Use” term. This is driven by their 25-year $6.5 billion federal contract to build the First Responder Network (FirstNet) to improve the nation’s preparedness in national emergencies. Under the FirstNet contract, AT&T is required to install additional equipment, batteries, generators, antennas, radios, and fiber optic interconnects to a substantial portion of its network of cell towers and rooftop sites. AT&T prefers “free for all” access to landlords’ properties to accomplish this requirement and sneak it in under the “Permitted Use” section of the lease. While this is just one paragraph in a very large lease, this is an area of focus for us in negotiating the future rights granted to AT&T as to not intrude on our client’s own property rights.

T-Mobile Cell Tower Lease Rates

T-Mobile’s corporate strategy for expanding the company and its customer base is through the acquisition of small wireless companies. T-Mobile’s two most recent acquisitions include MetroPCS (2013) and Sprint (2020). T-Mobile has been very quiet in recent years regarding building new cell towers in the US. As T-Mobile seeks to combine the engineering, marketing, operations and personnel of the newly acquired Sprint, T-Mobile is in the mode of deactivating duplicating cell tower leases instead of building new cell sites. Since the merger with Sprint in April 2020, T-Mobile has placed all of their new site development, along with all of Sprint’s in-process new tower builds, on an indefinite hold. Terabonne is now in negotiations with T-Mobile to terminate a number of duplicate cell tower leases on our clients’ properties. Until T-Mobile properly integrates all of its acquisitions to a single unified technology and operation, they will not be building any new cell towers in 2020 or early 2021.

Dish Cell Tower Lease Rates

Dish Network, known to many for its satellite dishes that bring hundreds of TV channels to our homes. As TV subscribers shift to online streaming from services such as Netflix and Amazon Prime videos, Dish struggled to look for ways to grow its business. Dish’s opportunity to enter the cellular business came from T-Mobile’s purchase of Sprint in April 2000 where T-Mobile sold off Sprint’s pre-paid phone business (think burner Boost Mobile phones) to Dish. Dish then spent $5 billion to purchase wholesale minutes from AT&T to resell to consumers under the Dish brand. This makes Dish a marketing company of wireless services. Click here for a deeper dive into Dish.

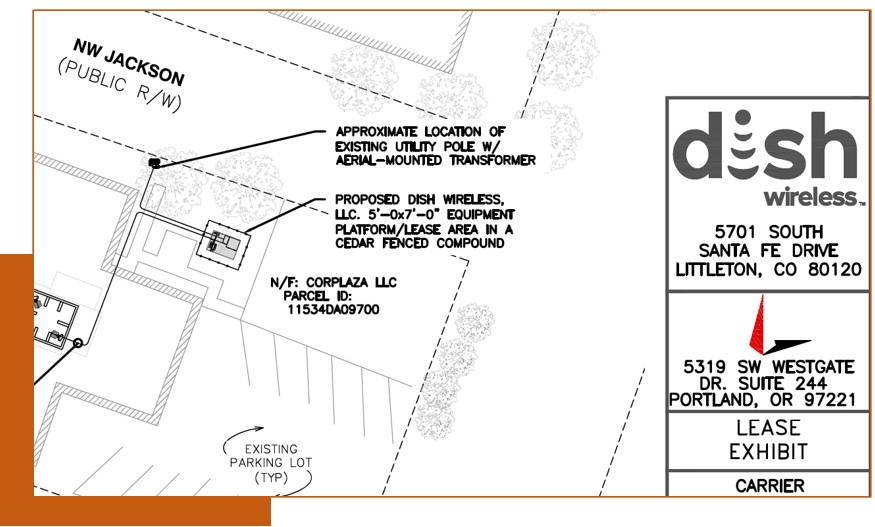

To become a truly national cellular company, Dish has to design its own cell sites, build its own network, install its own equipment, and market its own signals to be truly a self-standing wireless carrier. In fact, that is what Dish is doing. It is building a network of sites across the country under its own brand. To build fast and cheap, Sprint signed sweetheart deals with tower companies to collocate on existing cell towers for low rents in the initial years. They also focused their limited resources to rooftops and existing structures to hurry their network deployment. However, Dish came with the expectation that they can dictate low rents to landlords. Their argument is their space requirement is much less than that of the existing wireless carriers. But in fact, everything else is exactly the same, including trenching, parking, utility and access easement requirements, electricity, antenna attachments, etc… When working with Dish, Terabonne has a national lease that we spent the past years negotiating with their national team, and we insist on using such lease every time to protect our clients’ interests.

Need Advice?

Let’s discuss your cell tower opportunity. We will share with you what we know about your cell tower ground lease. Never a fee until we agree to work together and we deliver all-inclusive results to your satisfaction. Unheard of assurance and confidence. Please email, call or send us a message anytime.

Get In Touch

P.O. Box 6257

Edmonds, WA 98026