Wireless Insiders Now On Your Side

Right of First Refusal in Cell Tower Negotiations

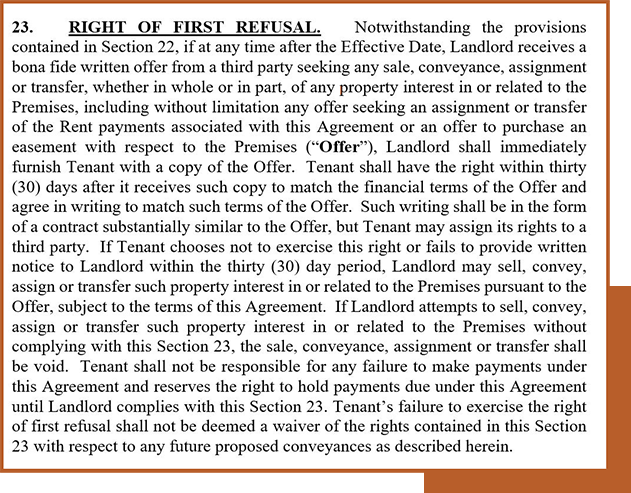

A Right Of First Refusal (ROFR) A ROFR grants the tower owner (wireless carrier or tower company) the right to match an offer by some third party who makes an offer to purchase your ground space (or rooftop) lease that you accept. While innocent sounding, this clause has pricing implications. clause grants the tower owner (wireless carrier or wireless tenant) the right to match an offer by some third party that makes an offer to purchase your cell tower lease. This clause can be written many different ways. A good contract will sharpen this lease term to the benefit of the property owners, leaving no chance for complications to arise in the event of a title transfer of the lease from you to someone else in the future. We write about real world implications to ROFRs with greater detail in the Lease Buyout discussion.

Suppose you decide to retire 20 years from now and want to sell your cell tower lease for lump sum cash instead of waiting around to collect rent for the next 40 years. When you find that willing buyer, if you have a ROFR in your cell tower lease, you cannot just sell your tower lease to that buyer. Depending on how the ROFR language was crafted in your lease, you may have to inform the tower owner (your wireless tenant) of your intent to sell and you must present the Offer Letter from the would-be buyer. You must give the tower owner an amount of time (defined in your tower lease agreement) to decide if they want to purchase the tower lease from you instead. The price of their purchase is dependent on the ROFR language in your lease. This can get very tricky when poorly negotiated ROFRs give your wireless tenant wiggle room to offer you a lower price than what you have been offered.

ROFR and Cell Tower Transaction Implications

A ROFR only matters to property owners if and when they decide to transfer their cell tower lease assets. Unfortunately, poorly negotiated leases allow this term to be too broad and do result in adverse implications to landowners in the future. Terabonne negotiators do grant ROFR rights to tower developers in some instances, but at some returned benefit to our property owner clients. We very narrowly define this right so that only in very specific situations can a wireless carrier or tower company exercise such rights during a property transfer involving our clients’ properties. For example, transfers of property title, even if it involves the cell tower lease, to family members, during estate planning, third-party fee simple purchases, etc. are all excluded from any ROFR rights granted to wireless tenants in our leases.

Having your wireless tenant (tower owner) review your property offers will delay the transaction you are considering. The length of delay depends on how clear and succinct the language was negotiated and written. If there are disputes about the language or interpretations, the delay is even longer. Suppose in the future you sell or quit claim your property to your children, does this qualify as a “sale” contemplated under the ROFR? If so, this transaction has to be reviewed by the wireless tenant, and they get to decide if they want to buy the property at the same terms offered to your child instead. If this is not your intention, the time to fix it is now before the lease is signed. Understanding our clients’ plans for their properties and having a long-term relationship with our clients motivate us to treat every lease negotiation as if it were our own property.

Terabonne’s Full Service Representation

Terabonne represents private property owners, farmers, commercial property owners, corporations, timberland owners, churches, universities… When we represent clients, we represent all aspects of wireless leasing and management for our clients. If there’s a dispute as to taxes, surveys, hazardous spills, back rents, road maintenance, encroachments, engineering designs, or rooftop structural loading; our staff is in the middle of it all. This includes right of first refusals and how to negotiate around such requirements. Many consultants who worked primarily in the cell tower buyout area tend to overemphasize ROFRs because of its impact on their business. When selecting a cell tower consulting firm, their depth and breadth of experience in the wireless industry is key criteria since one never knows the kinds of issues a cell tower design will encounter over the years.

Need Advice?

Let’s discuss your cell tower opportunity. We will share with you what we know about your cell tower ground lease. Never a fee until we agree to work together and we deliver all-inclusive results to your satisfaction. Unheard of assurance and confidence. Please email, call or send us a message anytime.

Get In Touch

P.O. Box 6257

Edmonds, WA 98026